Mississauga property tax rates increase in 2026: but by how much?

All departments at the City of Mississauga have cut their budgets by 2% or more, Mayor Carolyn Parrish has announced. This comes as the city’s draft budget has been made public prior to amendments and voting.

“We are watching your tax dollars closely and have reduced department budgets by over 2% for a $17.4 million dollar savings,” Mayor Parrish said in a video message. “Through tough choices and significant action, this budget will mean a residential property tax increase of 5.2% —1.6% of that is from the city.” The remaining increase comes from the Peel Region portion of the taxes.

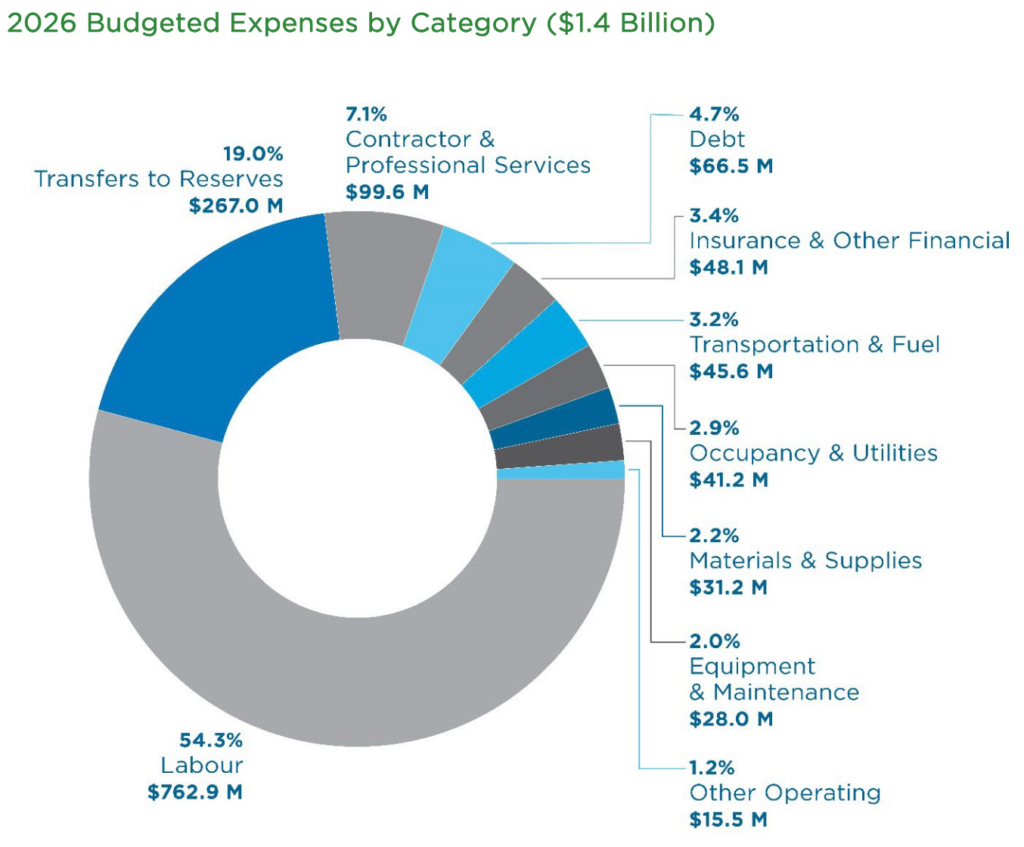

“The bulk of the increase has been attributed to rising labour costs, some of which went up due to arbitration for unionized employees.”

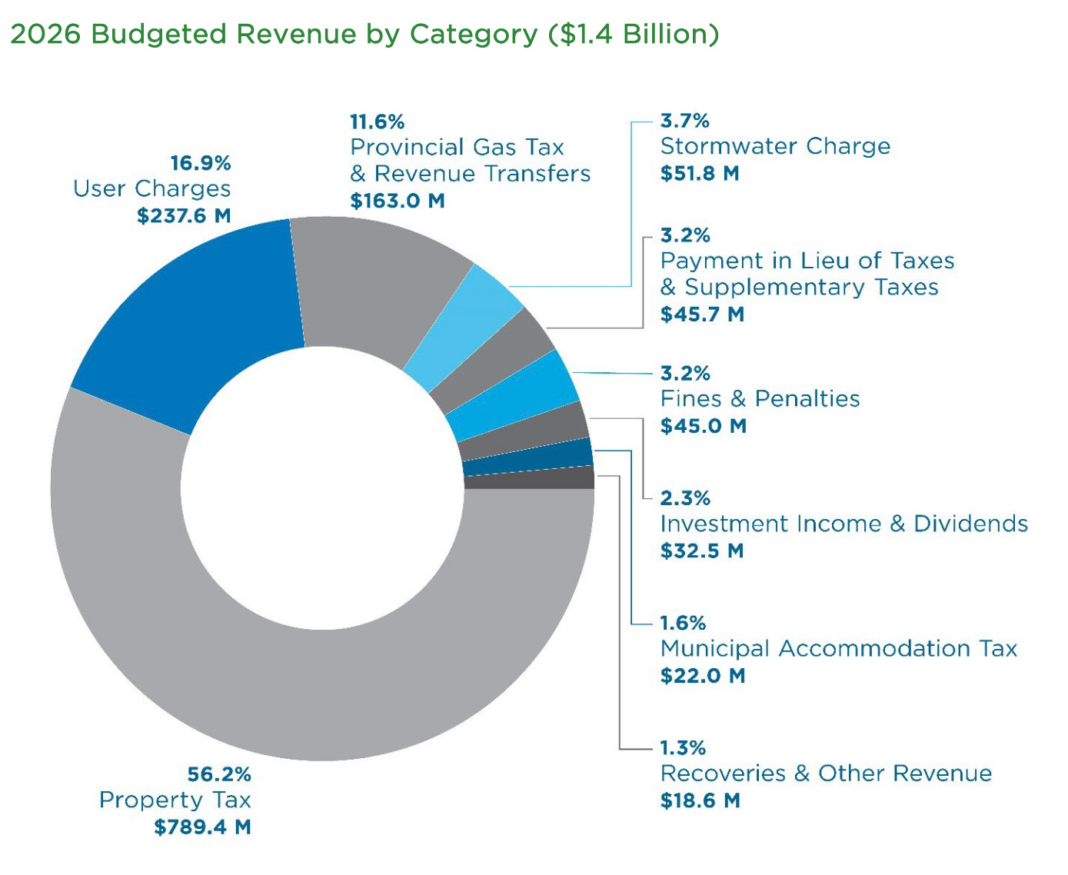

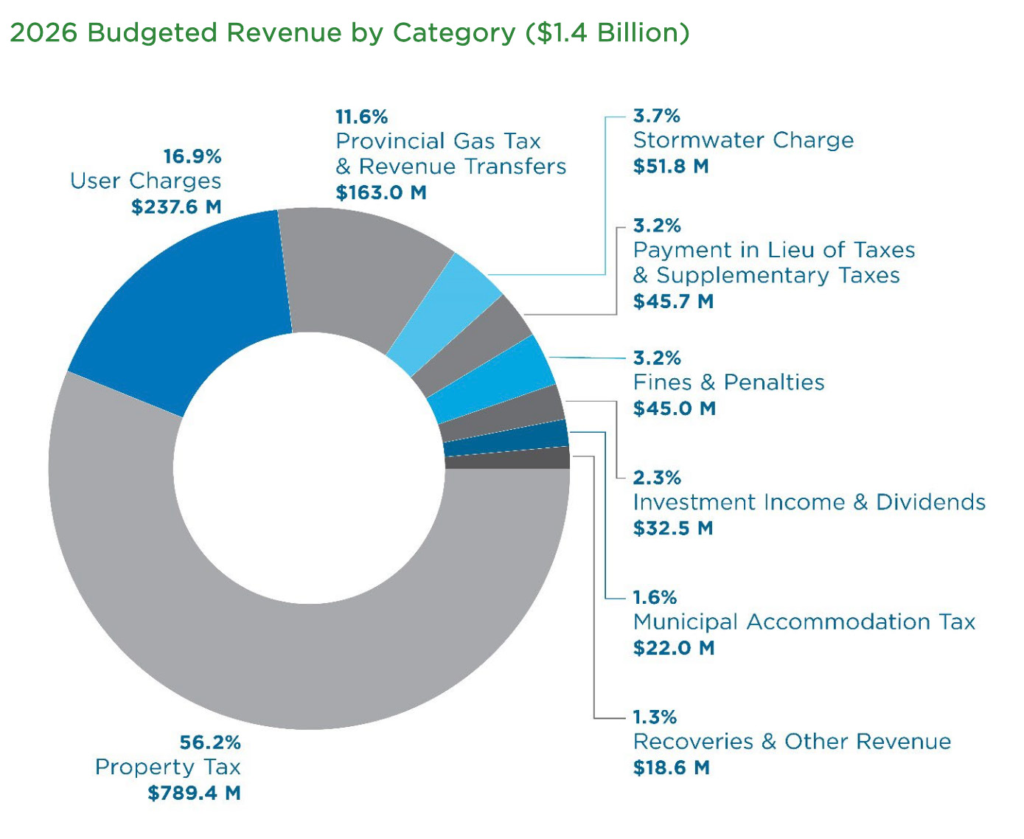

The operating budget has gone up by $77 million compared to last year, for an operating budget of $1.49 billion. The bulk of the increase has been attributed to rising labour costs, some of which went up due to arbitration for unionized employees. The city did, though, identify $573,000 in savings due to reduction in temporary and contract positions. Parrish goes to explain that there were initially plans for higher tax increases largely due to Peel Region figures, but after working with the City of Brampton they were able to reduce costs. That said, Mayor Parrish still says the Peel police budget is a “concern”, coming in at an increase of 9.9%. And she still believes that Brampton residents do not pay a sufficient share of the overall policing costs. “We remain committed to having our taxpayers treated fairly,” Parrish says.

One of the ways Mississauga is able to keep its local tax increase so low is that they have implemented a one-year reduction in the Capital Infrastructure & Debt Repayment Levy. While it was previously 3%, it will be 1% — this means that less money will be available for capital repairs and reducing the debt. The city will also be pausing the 1% tax rate level that goes to the Public Safety Fire Program.

Mississauga has to pass on the majority of the property tax dollars it receives to other levels of government. “From every property tax dollar collected, the city gets to keep only 37 cents, while 48 cents goes to the Region of Peel for police and other costs, and 15 cents goes to the Government of Ontario for education,” a city press release explains.

The city encourages residents to get in touch to voice their feedback on the budget via consultations, emailing budget@mississauga.ca and phoning 311 to leave comments.

The budget will be debated and voted on by Council on January 28.